The Significance of Comprehending the Importance of Risk Management in Different Industries

The Core Idea of Risk Management and Its Function

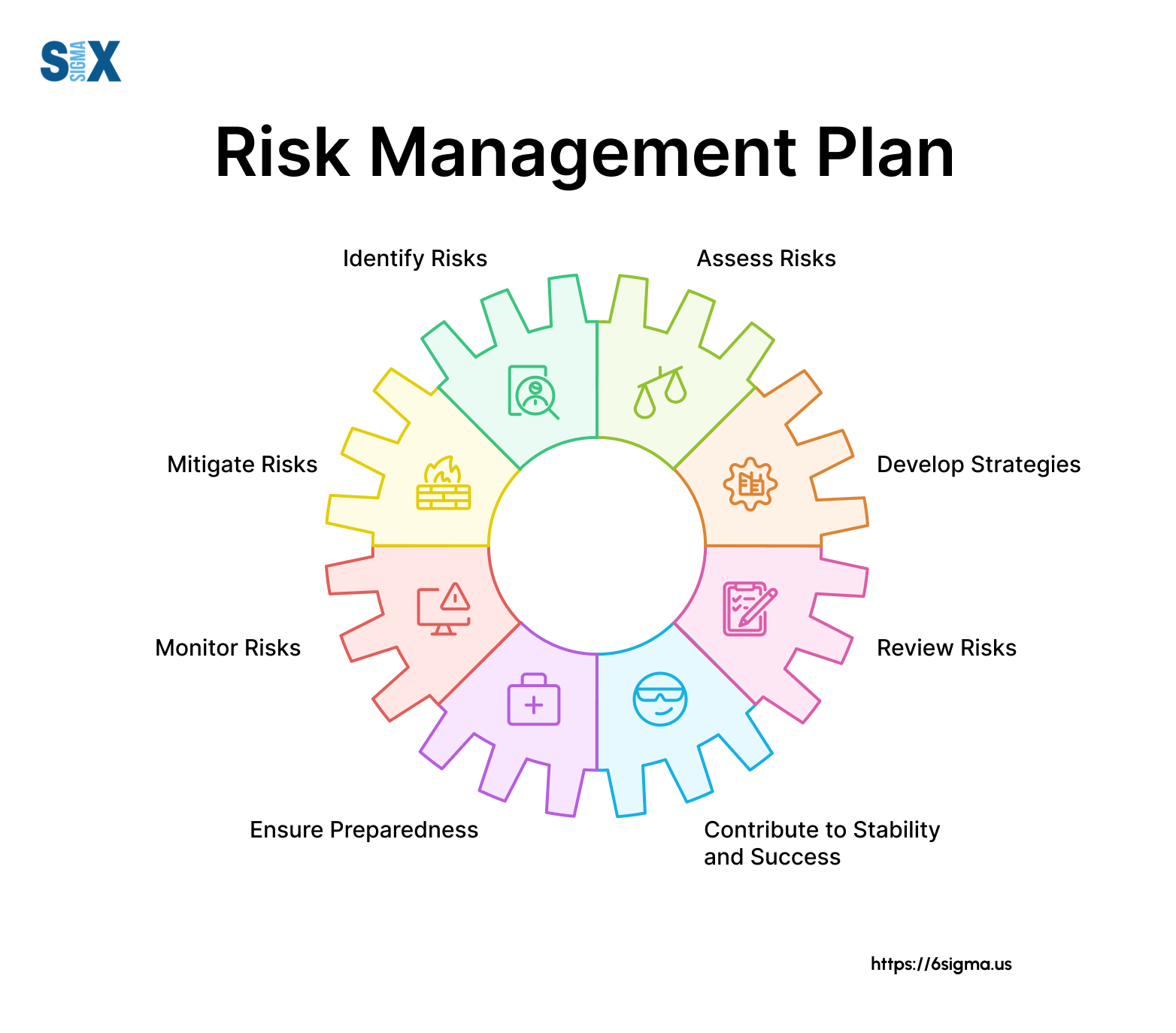

Risk Management, the foundation of many industries, pivots on the identification, analysis, and reduction of unpredictabilities in an organization environment. By properly recognizing potential risks, businesses can develop techniques to either stop these risks from occurring or decrease their influence. When dangers have actually been recognized and reviewed, the reduction process involves devising techniques to minimize their prospective effect.

Benefits of Carrying Out Risk Management in Business Operations

Revealing the Duty of Risk Management in Different Industries

While every sector challenges its unique set of risks, the application of Risk Management techniques remains a typical denominator in their quest of sustainability and development. In the health care field, Risk Management requires making sure person safety and information defense, while in finance, it involves mitigating financial investment risks and guaranteeing regulatory conformity (importance of risk management). Building and construction companies concentrate on worker safety and security, project delays, and spending plan overruns. In the technology market, firms alleviate cybersecurity hazards and technology obsolescence. Eventually, the duty of Risk Management throughout industries is to recognize, assess, and mitigate threats. It is an essential part of calculated planning, making it possible for organizations to secure their possessions, optimize possibilities, and achieve their objectives.

Real-life Study Demonstrating Successful Risk Management

To comprehend the importance of Risk Management in these several sectors, one can seek to a number of real-life circumstances that illustrate the effective application of these actions. In the power sector, British Petroleum developed Risk mitigation prepares post the 2010 Gulf of Mexico oil spill. They implemented much better safety treatments and stricter regulations which considerably minimized more mishaps. In money, Goldman Sachs efficiently navigated the 2008 economic crisis by recognizing potential mortgage-backed safeties threats early. Finally, Toyota, publish the 2011 quake in Japan, modified its supply chain Management to lessen interruption threats. These cases demonstrate just how markets, finding out from situations, effectively used Risk Management approaches to minimize future threats.

Future Fads and Growths in Risk Management Techniques

Cybersecurity, as soon as an outer issue, has actually catapulted to the forefront of Risk Management, with strategies visit concentrating on discovery, response, and avoidance. The integration of ESG (Environmental, Social, Governance) factors into check out here Risk Management is an additional expanding pattern, mirroring the enhancing recognition of the duty that ecological and social threats play in service sustainability. Thus, the future of Risk Management exists in the fusion of sophisticated technology, ingenious strategies, and an all natural method.

Conclusion

In conclusion, understanding the importance of Risk Management across a spectrum of industries is critical for their longevity and prosperity. Customized approaches can aid alleviate prospective dangers, guard possessions, and foster stakeholder depend on. Additionally, proactive decision-making help in regulative conformity and enhances source use. Inevitably, successful Risk Management contributes to more sustainable and resilient businesses, highlighting the importance of this practice in today's vibrant and extremely affordable company setting.

While every market faces its unique collection of risks, the application of Risk Management methods remains a common in their search of sustainability and growth. In the health care field, Risk Management requires making certain person security and data defense, while in money, it includes mitigating investment dangers and making sure regulative compliance. Inevitably, the duty description of Risk Management across sectors is to recognize, analyze, and reduce risks. These instances show how sectors, discovering from crises, effectively used Risk Management approaches to minimize future risks.

:max_bytes(150000):strip_icc()/operational_risk.asp-Final-4be32b4ee5c74958b22dfddd7262966f.png)